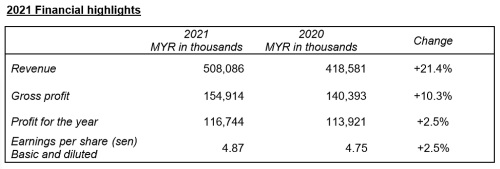

HONG KONG, Feb 25, 2022 – (ACN Newswire via SEAPRWire.com) – Pentamaster International Limited (“PIL” or “the Group”) which is listed under the Main Board of The Stock Exchange of Hong Kong Limited announced its financial results for the year ended 31 December 2021 today. The Group hit a new record in its 2021 revenue, registering at MYR508.1 million, whilst its net profit stood at MYR116.7 million for financial year ended 2021; marking an improvement of approximately 21.4% and 2.5% respectively from the corresponding period last year.

|

|

|

|

elements of the inter-segment transactions during the year |

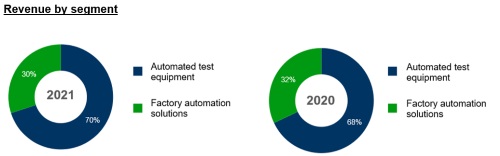

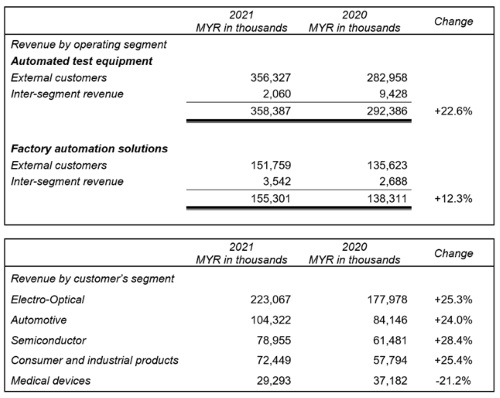

The overall performance of the Group recovered commendably in 2021, with growth driven by improved contributions from both the ATE and FAS business segments with each segment accounted for approximately 70.1% and 29.9% of the total Group’s revenue, as compared to 2020 of 67.6% and 32.4%, respectively.

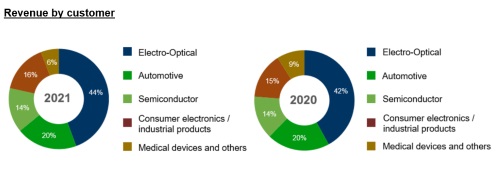

ATE segment

With a revenue contribution rate of 70.1%, the ATE segment continued to contribute the larger portion of the Group’s overall revenue and profit. After witnessing a decline in revenue last year, total revenue from this segment marked a turnaround and grew at a double-digit rate of 22.6% to MYR358.4 million. During the year, backed by the recovery of the smartphone market and its peripheral items. the electro-optical industry continued to dominate the ATE segment with its revenue contribution rate of approximately 49.7%, derived from a broad

product portfolio of the Group in its test solutions for proximity sensor, 3D magnetometer sensor, ambient light sensor, wafer level VCSEL (Vertical Cavity Surface-Emitting Laser) and other relevant applications under optics and photonics sensing solutions.

Owing to the Group’s persistent effort in increasing its exposure to the automotive industry, revenue from this sector came in as the second highest within the ATE segment with its contribution rate of 27.6%. In addition, the automotive sector chalked the highest growth rate at 39.9% among other industry sectors within the ATE segment. This strong demand was largely attributed to the Group’s automotive test solutions covering a full range of assembly and test technologies for various aspect of the manufacturing process ranging from component test, final test to packaging. During the year, the ATE segment was also benefitted from the semiconductor industry with its revenue contribution rate of 20.0%, where this sector captured a 26.8% growth as compared to 2020 from the continuous demand for the Group’s test handling equipment which was underpinned by the growth of integrated chips and other related semiconductor contents from the acceleration of digital transformation by the pandemic over the past two years.

The ATE segment will continue to dominate the performance of the Group in the foreseeable future. With the global pandemic unleashing the unprecedented wave of technology developments coupled with the power and momentum of technology convergence, the Group is in a promising position to leverage on these significant opportunities in the ATE segment.

FAS segment

After recording a strong revenue growth in year 2020, the FAS segment continued to witness double-digit growth rate in its contribution to the Group’s revenue, chalking 12.3% growth to achieve MYR155.3 million during the year. This was mainly driven by the robust demand for the Group’s proprietary i-ARMS solutions, where a wider customer base adopted this application across different industry segments in different countries and region. Notably, this segment gained its revenue momentum in the third and fourth quarter of the year, with revenue in second half of the year exceeding its first half by approximately 19.5%. The main industry segment that led to FAS growth was the consumer and industrial product segment, contributing approximately 45.4% to overall FAS segment revenue. This followed by the electro-optical segment and medical device segment with its respective revenue contribution rate of 30.4% and 19.3% where application of the Group’s i-ARMS was equally prevalent in

these segments.

The Group continues to witness huge potential and opportunities in its FAS segment given the fundamental shift towards factory automation and smart manufacturing across various industries especially in a post-pandemic environment. With the current automation trend, the Group will continue to broaden and enrich the capability of its automated solutions to capture the growth from these developments in the years ahead.

Outlook

“It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.”

The COVID-19 pandemic has dramatically and fundamentally altered the way we live and work. From social distancing, quarantine, closed borders, travel bans to the buzzword “home office” have never been mandated on such a large scale. The Group, however, navigated the “unsettling” effects of the pandemic and ended the financial year relatively “healed”. Such accomplishment has demonstrated the Group’s resilience in taking on the undeniable challenges that demand new ways of operating in a post pandemic business environment and its versatility and speed in emerging strongly owing to the hard work and concerted efforts of the employees of the Group.

As the saying goes, every cloud has a silver lining. The pandemic has pushed many companies over the technology tipping point and with the surge in automation, digital adoption has taken a quantum leap across many companies and industries. As a result of these developments, the Group embraces 2022 with increased optimism on the back of a strong order book momentum largely driven by another high growth potential year surrounded by several catalysts brought about by AI, big data analytics, IoT, self-driving cars, Industry 4.0 and the deepening application of 5G. With the electro-optical segment currently dominating the Group’s financial performance, this segment will continue its growth momentum in 2022, albeit modestly, given the Group’s growing exposure to other industry segments. In respect of the automotive segment, the Group expects to witness the continuous affluence of this segment with e-mobility emerging at an accelerated pace. With electrification playing an important role in the transformation of the transportation industry and thereby presenting major opportunities in all vehicle segments, the global transition specifically towards electric vehicles (“EV”) continues to get momentum and creates major disruption in the automotive industry and the related nexus. Significant efforts are witnessed through regulator worldwide defining more stringent emissions target which include, among others, the European Union CO2 emissions regulations for cars and vans, China’s New Energy Vehicles (NEV) mandate and Biden’s administration in introducing a 50% EV target by 2030. Given this context, the Group anticipates a favourable prospect for its automotive test solutions from front-end to back-end which will continue to provide an impetus to the Group’s overall performance.

In the belief that there is so much room and business opportunity for further expansion and that now is the best time to be planning for the future, the upcoming new manufacturing plant will pave the way for the Group to deepen its foothold in the medical device segment and bring the growth of its FAS segment to the next level. Key technologies that have been used widely in industrial manufacturing are seen to be filtering into the healthcare sector and with AI conquering the next frontier of the medical segment, the automation opportunity within this horizon is now abundant. With these technology developments presented, the Group is heartened to witness the growing demand for its automated assembly solutions from a broader customer base within the medical device segment on the back of an encouraging booking momentum. Together with the setup of Pentamaster MediQ Sdn. Bhd. for its involvement in the manufacturing of single-use medical devices, the Group is fully prepared for the huge market opportunities in the medical industry. Having continuously witnessed revenue growth from the FAS segment in the past two years, the Group continues to benefit from the increased focus of various industries on industrial automation which is now rapidly necessitated by the effects of the pandemic. As the surge in automation continues in the coming years with the use of AI and IoT in the manufacturing processes, the huge potential and opportunities in the FAS segment will be prevalent. Girded by a year of relatively stable financial performance in 2021, the Group will continue to focus fundamentally on its operational capabilities and remain proactive in the development of new cutting edge technologies and solutions. With a wide variety of challenges and opportunities confronting 2022, the Group, having the pulse on the global trends and requirements, is forward-looking in building another year of solid business growth. As it is, the virus is here to stay for a period of time and will be a reality in our daily lives. The Group’s priority is to ensure the safety of its employees with its strict adherence to the necessary safety measures and operating procedures.

About Pentamaster International Limited

PIL (HKEX stock code: 1665) is a leading global supplier in providing automation technology and solutions to multinational manufacturers mainly in the semiconductor, automotive, electrical & electronics, medical devices and consumer industrial products sectors spanning APAC, North America and Europe. The Group’s broad range of integrated automation products and solutions entails innovating, designing, manufacturing and installing automated equipment and/or automated manufacturing solutions.

To learn more about PIL, please visit us at www.pentamaster.com.my.

For media enquiries, please contact:

Email: investor.relation@pentamaster.com.my

Copyright 2022 ACN Newswire. All rights reserved. (via SEAPRWire)