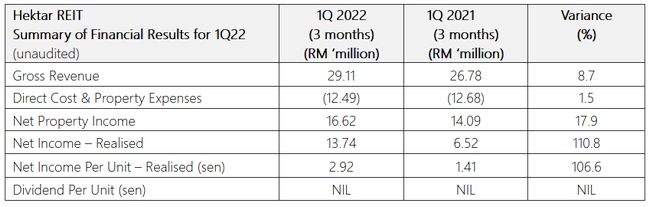

KUALA LUMPUR, May 23, 2022 – (ACN Newswire via SEAPRWire.com) – Hektar Asset Management Sdn. Bhd., the Manager of Hektar Real Estate Investment Trust (Hektar REIT), today announced the first quarter results ended 31 March 2022 (1Q 2022). Hektar REIT recorded revenue of RM29.11 million, an increase of 8.7% compared to the RM26.78 million recorded in the corresponding quarter of the previous year. The higher revenue is attributed to the increase in rental income, car park income and higher hotel occupancy, consistent with other retail and hospitality REITs. The overall retail sentiment for this quarter remained positive as it was supported by the increase in retail sales due to the pent-up demand from last quarter. Hektar REIT’s net property income increased 17.9% to RM16.62 million compared with RM14.09 million recorded in 1Q 2021, while realised income for the quarter under review gained 110.7% to RM13.74 million compared with RM5.52 million in 1Q 2021. Earnings per unit rose by 106.6% to 2.92 sen for 1Q 2022 compared with 1.41 sen for 1Q 2021.

|

|

Despite the dynamic & challenging environment, the Manager was able to bring in new tenants and secure the existing tenancies. Hektar REIT’s overall portfolio occupancy rate has remained steady at 84.8% in the quarter under review. Anchor support for Hektar’s malls remains positive as Golden Screen Cinemas (GSC) , our anchor tenant at Subang Parade, Central Square and Kulim Central, has started operating their business. The commitment by such an anchor tenant is a testament to the confidence in the long-term prospects of the malls. Hektar REIT is cautiously optimistic that there will be a gradual recovery as the country transitions into an endemic phase with the lifting of restrictions and reopening of the international borders.

Retail Group Malaysia (RGM) also expects the retail industry to recover in 2022 after posting a 26.5% growth rate year-on-year in 4Q 2021, which was above market expectations. RGM anticipates retail sales to grow by 6.3% in 2022. The Manager will maintain a cautious outlook for the coming quarters & continue monitoring the evolving situation and remain focused on ensuring the safety & well-being of our shoppers, tenants, employees and communities at all its properties.

Due to the prolonged COVID-19 pandemic & implementation of lockdowns in 2020 and 2021, the retailers are still in the early stages of recovery. Therefore, despite the improved performance of Hektar REIT, the Manager has decided to adopt a prudent approach by moving from quarterly to semi-annual income distribution as part of its long-term strategy to enhance the REIT’s capital management. Moving forward, subject to the financial performance of the REIT, the Manager intends to make distributions to the unitholders of Hektar REIT on a semi-annual basis for each six-month period ending 30 June and 31 December each year, unless otherwise determined and/or varied by the Manager at its sole discretion. However, the Manager remains committed to distribute at least 90% of Hektar REIT’s distributable income for the financial year ending 31 December 2022.

Hektar REIT remains committed to fulfill its obligation to ensure that business activities are performed to high standards of Environmental, Social and Governance (ESG). Various energy utilisation and optimisation initiatives since 2017 have been put in place for all of its shopping malls, resulting in a significant reduction in greenhouse gas emissions (recorded as CO2e) and energy usage over the last five years. Despite the pandemic, reducing the environmental footprint of our assets and operations remain a top priority. Our Waste Management initiatives have helped to reduce Waste Disposal by 156 tonnes or 22% compared to the same quarter in the preceding year. Hektar REIT is a constituent member of the FTSE4Good Bursa Malaysia Index and in its latest December 2021 evaluation, its ESG conduct has been recognised with a 3-star ESG rating by FTSE Russell.

Hektar REIT: http://www.hektarreit.com/

Copyright 2022 ACN Newswire. All rights reserved. (via SEAPRWire)